How We Unlock the Real Value of Paper Recycling

For many companies, paper and corrugated recycling is viewed as a necessary operational function. Plant managers see it as important, but often view it as limited in its financial impact. According to Don Gaines of Mid America Paper Recycling, that mindset often obscures a much bigger opportunity.

In this conversation, Gaines explains how disciplined execution, smarter logistics, and a clear understanding of material quality can transform a plant’s paper waste from a cost or afterthought into a managed asset with measurable value, regardless of market conditions.

Q: You often use the phrase “growing the worth of waste.” For executives who already recycle, what does that really mean?

A: Most companies come into recycling thinking about it defensively. They’re trying to reduce disposal costs, meet sustainability goals, or make sure they’re doing “the right thing.” All of that matters, but it’s not where real value is created.

When we talk about growing the worth of waste, we’re talking about shifting mindset from waste as an unavoidable byproduct in your production to waste as a managed asset. Paper and corrugated have inherent value, but that value is fragile. It’s either preserved through good execution or destroyed through poor handling. Our job is to help companies move from simply moving material offsite to actively managing how that material is captured, prepared, and sold into the market in a way that improves their financial outcome.

Q: Many companies feel they’re either being charged by a hauler to get rid of paper or not being paid enough for it. Why is that so common?

A: Most recycling programs were designed for convenience, not optimization. When paper is being collected the same way trash is collected, handled by the same vendors, and shipped the same way, it’s almost guaranteed to be undervalued.

What we see over and over again is material that could command a higher price is being commingled, contaminated, or downgraded before it ever reaches a buyer. Consequently, by the time it’s priced, the opportunity to increase revenue returns is already gone. Companies assume that’s just “the market,” when in reality it’s the result of how the material leaves their building.

Q: So where do you actually begin fixing that?

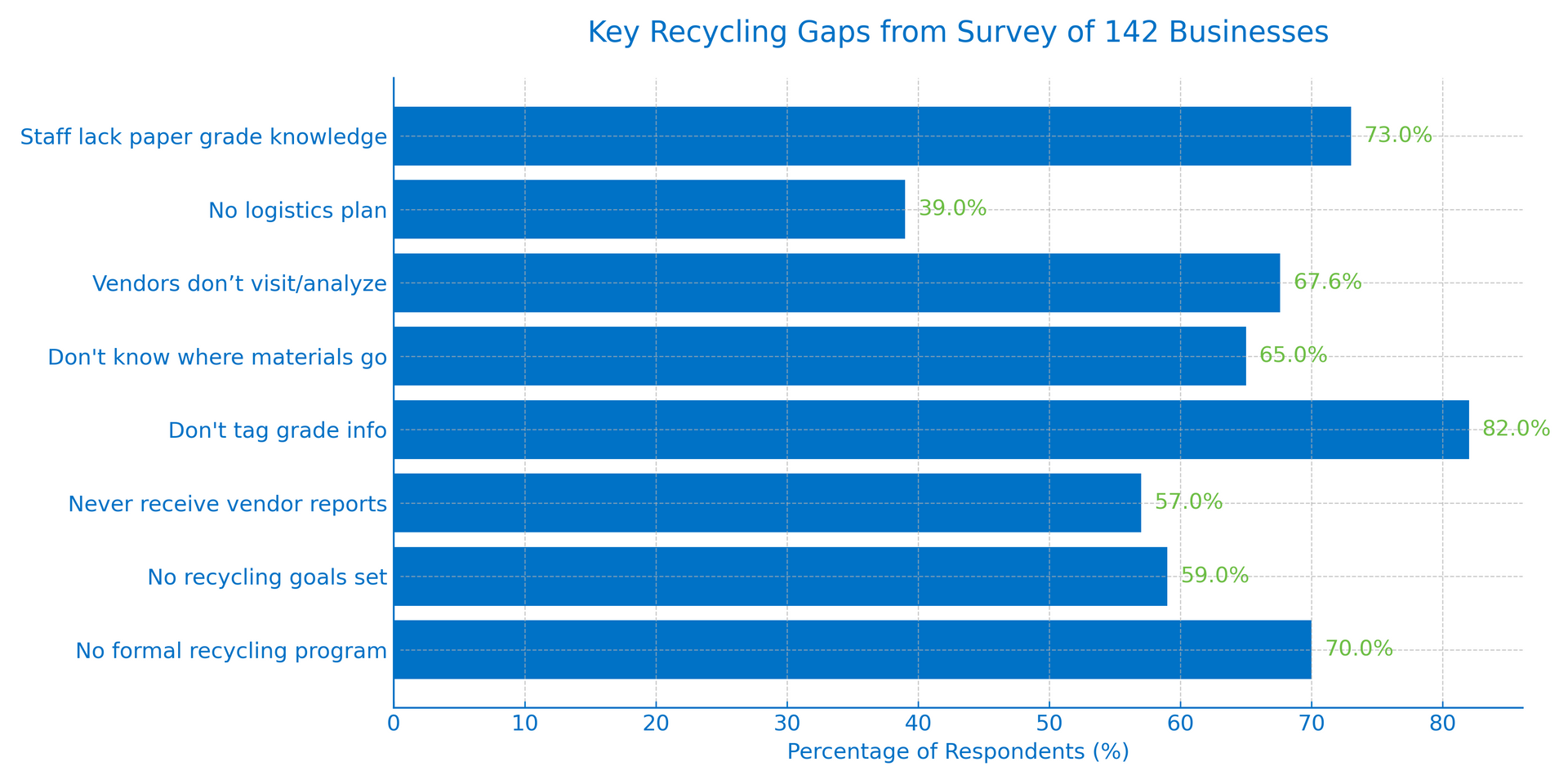

A: We always start with a simple waste audit, because it tells us how mature a company really is in its recycling journey. Not every organization is at the same stage, and the questions you ask should change depending on that maturity.

The audit looks at how material is collected on the floor, how consistently it’s segregated, what equipment and labor are involved, how logistics are handled, and what the company is actually trying to accomplish financially. When you step back and look at all of that together, patterns emerge very quickly. You can see where value is leaking out of the system and where small operational changes can have outsized financial impact.

Q: Segregation comes up a lot in recycling discussions. Why does it matter so much at a financial level?

A: Because paper markets don’t reward averages. They reward precision. The cleaner and more consistent a certain paper or corrugated grade is, the more usable it becomes to a mill, and therefore the more valuable it is.

When different grades are mixed together, everything prices to the lowest-quality component. That’s not a market problem, it’s an execution problem. When companies take the time to separate material properly and train their plant teams on the floor on why it matters, we often uncover valuable grades they didn’t even realize they were producing. Suddenly, what looked like this marginal waste material starts contributing real revenues. People start paying closer attention.

Q: At what point does baling or even shipping directly to mills become realistic?

A: It’s less about company size and more about volume consistency and discipline. We’ve worked with mid-sized plant operations that absolutely generate enough of a single grade to justify baling or even mill-direct loads.

Once you reach that point, the economics change. Baling improves density and freight efficiency. Mill-direct shipments remove layers of handling and allow pricing to reflect how the fiber actually performs in a mill environment. That’s where deep market knowledge and brokerage connections matter. Knowing which mills want which grades and why. Those relationships are built over decades, and they’re a big part of how we help clients unlock incremental value.

Q: How important is logistics in all of this?

A: It’s critical, and it’s often overlooked. If recyclable paper is leaving your facility in a garbage truck, it’s being treated like garbage all the way down the line. That affects cost, quality, and ultimately price.

We spend a lot of time rethinking how material moves. How often it’s picked up, how it’s staged, how full loads are built, and where they go. Small changes in logistics can be the difference between a recycling program that’s cost-neutral and one that’s meaningfully profitable.

Q: How do senior leaders decide what to tackle first without overengineering the program?

A: That’s exactly why the waste audit matters. A company that’s still struggling with basic material segregation shouldn’t be talking about high-value mill-direct shipments yet. On the other hand, a sophisticated operation may already be doing the basics well and leaving money on the table through legacy recycling contracts or inefficient hauling procedures.

The goal isn’t to do everything at once. It’s to understand where you are today and make targeted incremental improvements that build on each other over time. Recycling done well is a continuous improvement process, not a one-time project.

Q: What’s the biggest misconception management has about recycling economics?

A: That pricing is out of their control. Markets move, of course, but how your material shows up in that market is entirely controllable. Two companies producing the same paper waste can have very different outcomes depending on how well they manage the details.

When executives see recycling as a static commodity transaction, value stays flat. When they see it as an operational system that can be optimized through partnership, value grows.

Q: What does success look like when companies get this right?

A: Success looks like predictability. Recycling revenue becomes something you can forecast instead of something you explain away. Disposal costs shrink. Operational surprises disappear. Internal teams understand why processes matter, not just what they’re supposed to do.

At that point, recycling stops being a compliance exercise and starts behaving like a quiet but reliable contributor to the business. As a starting point, Mid America Paper Recycling offers a free online waste audit that allows you to quickly assess how your recycling program is structured today and where potential vulnerabilities may exist. Begin yours today, or contact us for a consultation.