Cost Avoidance VS. Cost Reduction

Cost Avoidance vs. Cost Reduction: The Hidden Value of Smarter Recycling Logistics

For most companies, a recycling operation is treated as a cost center. The conversation usually revolves around cutting hauling bills, minimizing landfill fees, or negotiating freight rates. Those are real expenses, but they represent only a slice of the true financial picture. What rarely gets considered are the hidden costs of inefficiency. The dollars lost when trailers sit idle, when bales are downgraded or rejected, or when valuable material is mixed into lower grades.

Mid America Paper Recycling has documented how quickly those costs add up. For one large customer-partner, converting loose material to baled shipments increased net income by more than $250,000 in just six months. Better grade separation and direct mill shipments created another $225,000 in net income. Those aren’t one-time savings, either. They’re examples of how smart recycling management prevents unnecessary costs from ever hitting the books.

This is the distinction between cost reduction and cost avoidance. Reduction trims what you’re already spending. Avoidance stops inefficiencies and bottlenecks before they generate costs in the first place. In recycling logistics, the difference is measured not in pennies per ton, but in hundreds of thousands of dollars per year.

Why Logistics Is the Pressure Point

When material leaves the plant floor, the real test begins. Recycling logistics is more than arranging a truck to show up. It’s the system that ensures material keeps moving, docks don’t clog, and downstream outlets don’t dry up. Done poorly, it produces a cascade of hidden costs. Done well, it becomes a margin enhancement driver.

Take something as basic as trailer flow. If empty drop trailers aren’t staged in time, balers sit idle and material piles up. If full trailers aren’t moved quickly, dock space disappears and production teams work

overtime to make room. Those inefficiencies create measurable costs, yet they’re easily avoided with proactive logistics management. The same is true of routing. A well-managed program anticipates backhauls, balances volume across regional outlets, and adjusts quickly when markets shift. That agility prevents unnecessary freight bills, overtime, or emergency fees.

Lessons from Mill Closures

Nowhere has the importance of logistics and cost avoidance been clearer than in the wave of paper mill closures hitting the industry. Over just the past 100 days, several major shutdowns have been announced across the United States, creating immediate challenges for companies that rely on these

outlets.

International Paper is shuttering its Savannah, Georgia, paper mill and related packaging facility by the end of September 2025. The company is also closing its Riceboro, Georgia, operations, which include

both paper and timber facilities. In Chillicothe, Ohio, Pixelle Specialty Solutions permanently closed its longstanding paper mill in August, a move that rippled into the local logging industry as well as downstream suppliers. Georgia-Pacific has announced it will close its Cedar Springs containerboard mill.

Other closures are reshaping the map. International Paper is shutting down its Georgetown, South Carolina, pulp mill, while packaging facilities in Statesville, North Carolina; Kansas City, Missouri; and

Rockford, Illinois, have all recently ceased operations. Taken together, the volume once absorbed by these mills is now competing for fewer outlets.

For companies in these local markets that relied on a single downstream buyer, the result has been trailers sitting longer in yards, higher freight bills to reach new destinations, or stockpiles of fiber with no

immediate outlet. Those that navigated the closures successfully weren’t the ones chasing the lowest hauling rate. They were the ones with contingency plans, alternate outlets, and logistics systems flexible

enough to redirect material within days instead of weeks. The difference between scrambling and staying steady shows up directly on the P&L.

Professional Management Makes the Difference

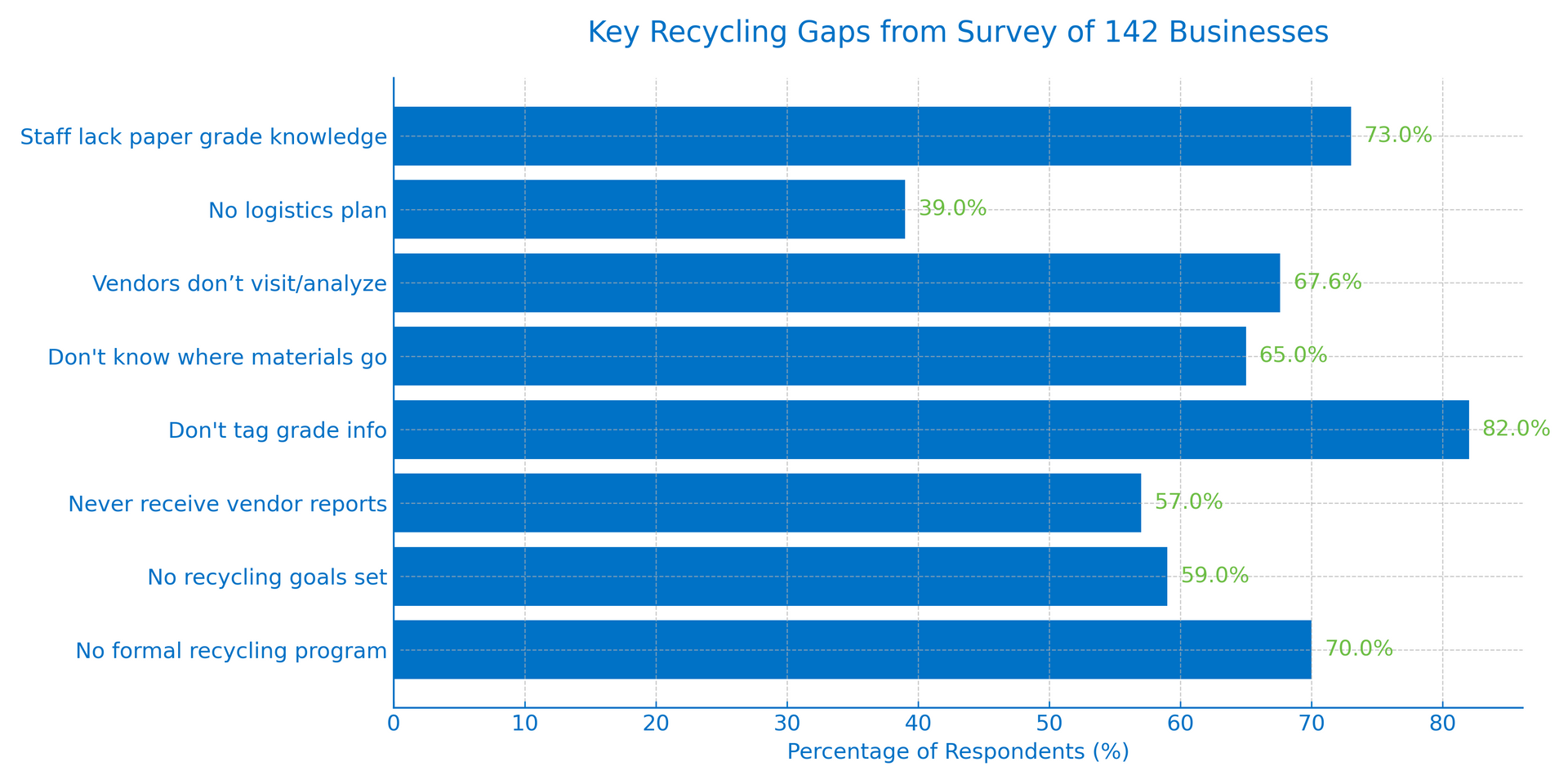

We often see too many recycling programs are managed on autopilot. A hauler arrives when scheduled, fiber is sold when convenient, and reports show up long after the fact. That approach may keep material

moving in good times, but it leaves companies exposed when markets tighten or outlets close.

The companies that come out ahead treat recycling as a managed supply chain. They invest in detailed waste audits to uncover hidden revenue, use timely reporting to track bale weights and freight costs,

and rely on experts to anticipate market disruptions before they hit. They even pay attention to details like bale wire and ties, because a jammed line or a broken bale isn’t just a nuisance, it’s downtime that creates avoidable labor and maintenance costs.

Recycling Seen From the CFO’s Chair

Finance leaders understand the difference between a one-time cost cut and a system designed to prevent recurring expenses. Cutting costs can be quick, but it’s often temporary. Avoiding costs builds resilience into the system. That resilience shows up as steady throughput, consistent revenue, and smoother operations, even when markets are volatile.

A Stronger Bottom Line

Recycling should never be seen as a static line item. It’s a dynamic part of the supply chain with the potential to either erode or enhance your profitability. Focusing only on reduction leaves dollars on the table and exposes operations to risk. By contrast, companies that prioritize cost avoidance through smarter logistics turn recycling into a source of strength. In a market shaped by mill closures, shifting outlets, and rising freight, that hidden value isn’t a “nice to have.” It’s an essential “must have.”

If you think there’s more value to be found in your recycling program, there probably is. And we’re here to help you find it. Click here to get started: https://www.midamericapaper.com/waste-reduction-audit