What to Do When Georgia Paper Mills Shut Down

Georgia has long been a powerhouse in the paper and packaging industry. Mills in Savannah, Riceboro, and Cedar Springs have supported a vast network of converters, manufacturers, and recycling operations for decades. But with multiple closures announced across the state, the landscape for recovered fiber is shifting fast, and so must the companies that depend on it.

In the past year, several major players have announced plans to exit or consolidate operations in Georgia. International Paper is closing its Savannah paper mill and related packaging facility by the end of September 2025 and shutting down its Riceboro plant, including timber and lumber operations. Georgia-Pacific’s Cedar Springs containerboard mill is also scheduled to close, removing a significant amount of regional fiber demand.

While the headlines have focused on what these closures mean for jobs and local economies, the deeper and more immediate concern for recycling generators is what happens next to their fiber flow. With three large mills going offline, thousands of tons of recovered paper that once stayed in-state now need new destinations. That shift affects everything from freight rates to bale scheduling and pricing stability.

For many Georgia manufacturers, converters, and distribution centers, the change has revealed how closely recycling performance depends on logistics. When local outlets disappear, so do short hauls, predictable pricing, and fast turnaround times. Full trailers sit longer, freight bills climb, and recyclable materials that once generated consistent revenue can become costly to manage.

That’s why companies across the Southeast are re-evaluating their recycling strategies and vendor partnerships. The key lesson is clear: proactive logistics management is the best defense against disruption.

When a mill closes, fiber that once had a short, steady route to market must now compete for limited capacity across longer lanes. Haulers redirect loads to new regions, brokers search for alternate mill contracts, and small inefficiencies quickly multiply into real expenses. Without a coordinated plan, even the most disciplined recycling programs can find themselves squeezed between freight and storage costs.

Mid America Paper Recycling helps companies stay ahead of that curve. By maintaining a broad network of domestic and international mill relationships, we can reroute recovered paper quickly to keep materials moving and pricing stable. Our logistics systems anticipate regional bottlenecks, ensuring trailers are staged, released, and replaced on schedule.

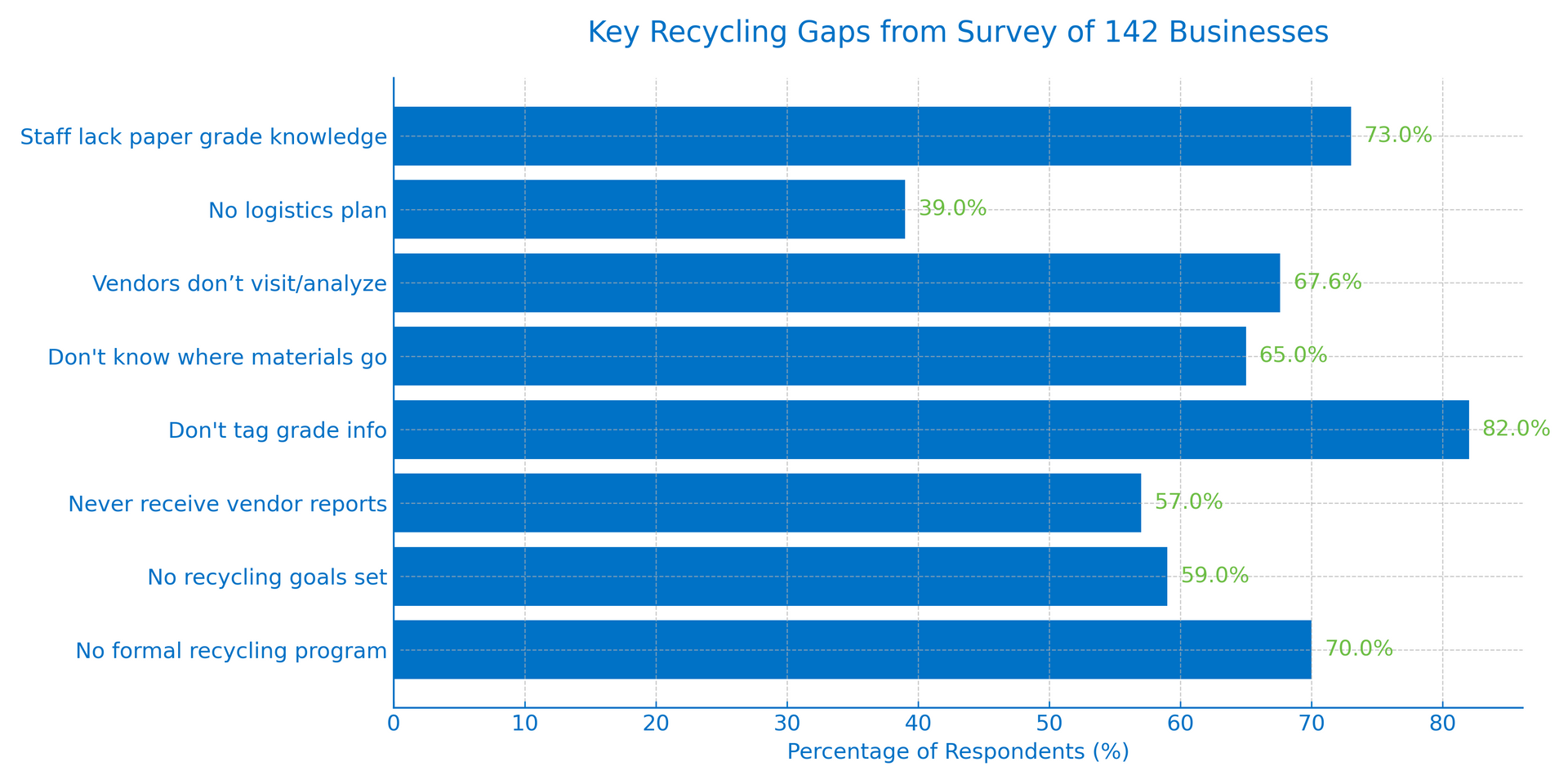

Another essential step is a free online waste audit that identifies unrealized value within the recycling stream. Many Georgia operations still ship mixed or compacted waste that could yield higher returns with better separation and baling. Converting loose material to baled shipments and managing grades more precisely can often offset higher transportation costs with improved per-ton pricing.

Equally important is transparency. In a volatile market, data on bale weights, freight costs, and material values allows operators to make informed decisions in real time. MAPR’s advanced reporting systems give both plant managers and finance leaders the visibility they need to minimize risk and maximize return.

Georgia’s mill closures may mark the end of an era, but they also highlight a new opportunity. By strengthening logistics, broadening outlet access, and refining recycling practices, companies can continue to turn waste into value, even in a changing market.

The goal remains the same: keep material moving, keep revenue flowing, and keep recycling profitable.

Ready to get started? Take our online waste audit now.

Once you take the survey, we will send you a free report on your waste stream. Complete the waste audit survey by clicking the button below.

Need Help With Your Company’s Paper Recycling in the Savannah, GA Area?

Mid America Paper Recycling serves the entire Savannah, GA region. Our team can assist with all your commercial paper recycling needs.